Why I keep the Capital One Venture in my wallet

Disclosure: This post may include affiliate links and links to credit cards that we use. For all affiliates, we earn a small percentage of any purchases. When we share links to credit card applications, if you click on that link and are approved, we will be compensated with points at no additional cost to you. We will never share any products or credit cards that we do not use ourselves.

[Update] January 2026: Capital One has a new ELEVATED offer out. In addition to 75,000 points, you can earn a $250 travel credit. This means that you can easily get $1000 value out of the sign-up bonus for this card.

The other day, my husband (player 2 in the points and miles world) was trying to decide which card he should downgrade. He gets a little nervous when those annual fees are do, and since I do most of our travel planning and have more cards open than he does, he’s not always sure that his cards are valuable.

When he mentioned that he wanted to close his Capital One Venture card, which only has an annual fee of $95 per year, I was surprised.

So, since I’ve been recommending this card to friends, and since I’ve had a Venture card in my wallet for 6 years now, it seemed like a good time to explain WHY I would not close this card, and how it’s served us over the past few years.

Capital One is accepted everywhere

If you are from the United States and travel abroad often, the Capital One Venture card is part of Visa, so it will be accepted anywhere. Capital One cards do not carry an international transaction fee, so you will not have any surprises when you are moving from one country to another. While we love our American Express Gold card, when we traveled this summer throughout western and central Europe, there were a number of places that would not accept American Express. If you have one primary card in your wallet, you want it to be a visa.

2. Venture redemptions are as easy as cash back

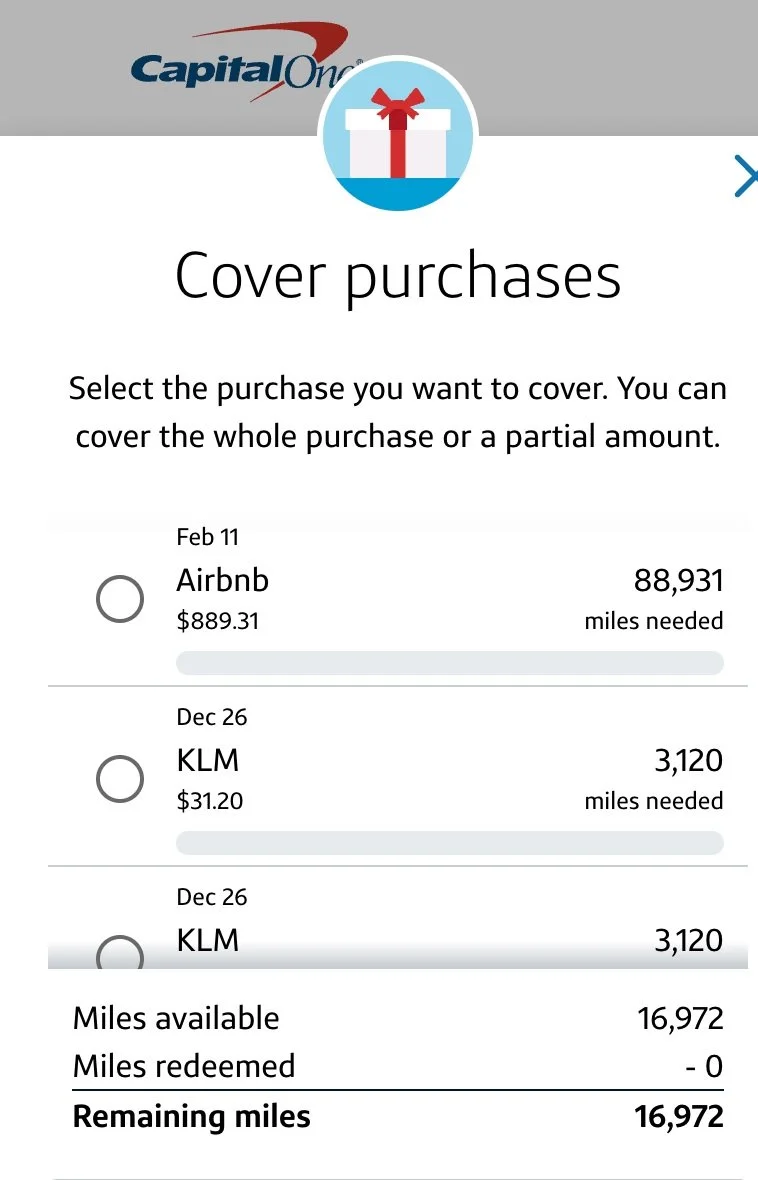

If you are busy, and do not have time to fully understand the world of miles and points, then the Capital One Venture card is the best choice for you. After you make an eligible travel purchase using the Venture card, you can just ERASE that purchase. Your Capital One account knows which purchases are coded as travel. If you do not want to worry about brand loyalty with airlines and hotels, then this is the easiest card for a newbie.

Sample redemption screen for Capital One Venture X

3. The Capital One Venture has amazing rental car insurance

When we were in Iceland, we spent one single night in Reykjavík. During the night, we left our rental car parked on the street behind our guest house. We woke up the next day to find the passenger mirror hanging off the car, and when we returned it to Blue Car Rental at the airport, we had to pay an additional $900. We used the Capital One card to pay for the car rental AND to cover these fees. When we returned home, we filed a claim with Capital One, and received a full refund from them. Anytime we rent a car, we use our Capital One Venture card.

4. You can get the credit card bonus TWICE.

We signed up for the Capital One card years ago. But, last year, we upgraded one card to the Venture X, and without a credit inquiry, we were able to earn another 75,000 miles. The annual fee is high on the Venture X, it’s $395 a year. However, it automatically comes with $300 for hotels booked through the Capital One portal, which makes it equal to the more Venture.

5. Transfer partners

Capital One has 15 airline transfer partners and 3 hotel partners. While there are not as many US based airlines in the Capital One portfolio, if you travel abroad, you will easily find ways to use these points. For example, we flew KLM to Europe last summer, and we are flying British Airways on the way home from Dublin this summer. We will also be using FinAir to travel to Finland and Sweden. These 3 airlines are all based in Europe, but they also get us home to the east coast of the US.

While this is not how we primarily use our Capital One points, having the option to top off your airline miles can be very beneficial if you want to avoid paying cash for flights.